All Categories

Featured

Table of Contents

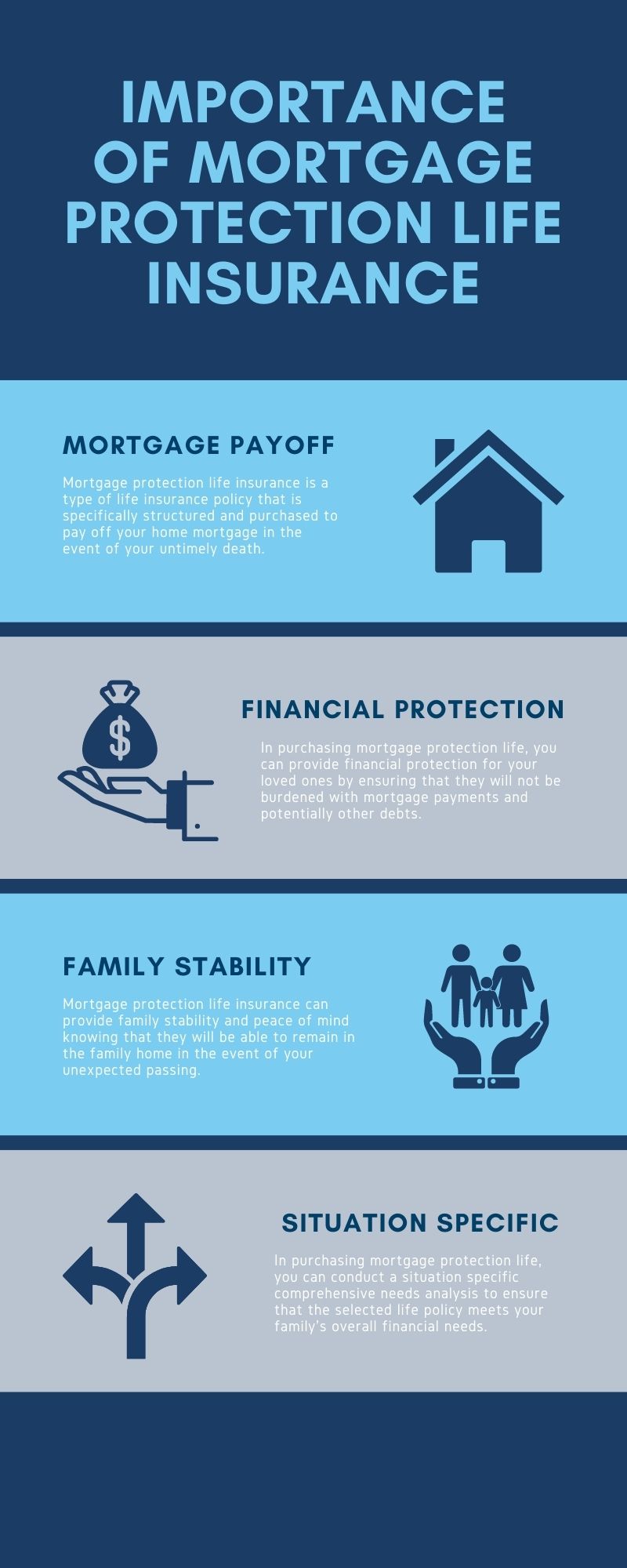

Life insurance policy helps make certain that the financial debt you owe toward your home can be paid if something happens to you. It makes sense to have a policy in location making sure that your family will be able to keep their home no issue what lies in advance.

In many cases, a mix of protection kinds may give more benefits than a solitary item option, far better safeguarding your home in the event that you pass away suddenly. The balance owed on your home loan would certainly constantly be covered by the mix of one or multiple life insurance coverage policies. mortgage loan insurance. Using life insurance policy for home loan protection can alleviate the threat of someone being entrusted an uncontrollable financial problem

Customizing your insurance coverage can give short-term defense when your home mortgage quantity is highest possible and long-term defense to cover the whole period of the mortgage. The mix technique can work within your spending plan, offers flexibility and can be designed to cover all home loan payments. There are numerous ways to make use of life insurance to aid cover your mortgage, whether with a mix of policies or a single plan customized to your needs.

This plan lasts for the full regard to your home loan (30 years). In case of your death, your family can use the survivor benefit to either settle the mortgage or make continued home loan payments. You buy a whole life insurance coverage policy to offer lasting protection that fits your monetary circumstance.

When it pertains to protecting your loved ones and ensuring the financial protection of your home, recognizing mortgage life insurance policy is crucial - how much is mortgage protection. Home mortgage life insurance coverage is a specific type of protection made to settle mortgage financial obligations and associated costs in case of the debtor's death. Allow's check out the kinds of home loan life insurance policy readily available and the advantages they supply

This kind of insurance policy is commonly made use of along with a standard home mortgage. The size of the plan reduces with time according to the outstanding balance of the mortgage. As mortgage repayments are made, the death benefit decreases to match with the new amortized home mortgage equilibrium exceptional. Lowering term insurance makes sure that the payment aligns with the continuing to be home loan debt.

Mortgage Life Insurance Average Cost

Unlike decreasing term insurance, the dimension of the policy does not lower gradually. The plan offers a set death advantage that continues to be the same throughout the term, no matter of the outstanding home loan balance. This sort of insurance is well-suited for consumers who have interest-only mortgages and intend to make sure the full home loan amount is covered in the event of their death.

, a number of elements come into play. State and federal regulations play a considerable duty in establishing what takes place to the home and the mortgage when the proprietor passes away.

These regulations dictate the process and options available to the successors and beneficiaries. It is necessary to comprehend the details laws in your jurisdiction to navigate the circumstance efficiently. If you have called a beneficiary for your home in your will, that person normally does not have to take control of your home mortgage, given they are not co-borrowers or co-signers on the funding.

Average Mortgage Life

The decision inevitably resides the heir.It's critical to consider the monetary effects for your beneficiaries and recipients. If the assumed successor fails to make home mortgage payments, the lending institution maintains the right to confiscate. It might be needed to make certain that the heir can manage not just the home loan settlements yet also the recurring expenditures such as real estate tax, house owners insurance policy, and maintenance.

In most situations, a joint customer is likewise a joint owner and will end up being the single proprietor of the residential or commercial property (pros of mortgage insurance). This indicates they will presume both the ownership and the mortgage commitments. It is necessary to note that unless a person is a co-signer or a co-borrower on the lending, no one is legally obligated to proceed paying off the home loan after the debtor's death

If no person thinks the home mortgage, the home loan servicer might start repossession proceedings. Comprehending the state and federal laws, the effect on successors and recipients, and the duties of co-borrowers is critical when it comes to navigating the complicated world of mortgages after the fatality of the consumer. Seeking lawful advice and considering estate preparation alternatives can help guarantee a smoother shift and secure the rate of interests of all celebrations included.

Mortgage Debt Insurance

In this section, we will explore the topics of inheritance and home loan transfer, reverse home mortgages after death, and the role of the surviving partner. When it pertains to acquiring a home with a superior mortgage, a number of aspects enter play. If your will names a successor to your home who is not a co-borrower or co-signer on the financing, they usually will not need to take control of the home mortgage.

In situations where there is no will certainly or the heir is not called in the will, the responsibility is up to the administrator of the estate. The administrator ought to continue making home mortgage payments making use of funds from the estate while the home's destiny is being identified. If the estate does not have enough funds or properties, it might need to be liquidated to repay the home loan, which can produce issues for the successors.

When one customer on a joint home mortgage dies, the making it through spouse usually comes to be totally in charge of the home mortgage. A joint borrower is likewise a joint proprietor, which suggests the enduring spouse ends up being the single proprietor of the residential or commercial property. If the mortgage was applied for with a co-borrower or co-signer, the various other event is legally bound to continue making finance payments.

It is crucial for the making it through partner to interact with the lending institution, recognize their legal rights and obligations, and check out available choices to make certain the smooth continuation of the mortgage or make essential plans if required. Comprehending what occurs to a home mortgage after the fatality of the property owner is essential for both the successors and the surviving partner.

When it concerns safeguarding your liked ones and making certain the settlement of your mortgage after your fatality, mortgage security insurance coverage (MPI) can give useful coverage. This sort of insurance coverage is especially created to cover superior mortgage settlements in case of the customer's fatality. Allow's discover the insurance coverage and advantages of mortgage protection insurance policy, in addition to vital considerations for registration.

In the occasion of your death, the survivor benefit is paid directly to the home mortgage lender, ensuring that the impressive lending equilibrium is covered. This permits your family to remain in the home without the added stress of prospective economic hardship. Among the benefits of mortgage protection insurance is that it can be a choice for individuals with severe illness that might not get approved for traditional term life insurance policy.

Va Mortgage Insurance Coverage

Enlisting in mortgage protection insurance policy requires cautious factor to consider. It's essential to assess the conditions of the plan, including the protection amount, costs repayments, and any exclusions or constraints. To acquire home loan security insurance coverage, typically, you need to sign up within a couple of years of shutting on your home. This makes certain that you have coverage in location if the unanticipated occurs.

By recognizing the insurance coverage and advantages of home loan protection insurance, in addition to meticulously reviewing your choices, you can make informed decisions to secure your family's financial wellness even in your lack. When it comes to managing home mortgages in Canada after the fatality of a house owner, there specify regulations and regulations that come right into play.

In Canada, if the departed is the sole proprietor of the home, it becomes a property that the Estate Trustee called in the person's Will should take care of (refused mortgage protection). The Estate Trustee will require to prepare the home available and use the profits to settle the continuing to be home mortgage. This is required for a discharge of the house owner's loan agreement to be signed up

Table of Contents

Latest Posts

Mortuary Insurance

Group Funeral Insurance

Final Care Expenses

More

Latest Posts

Mortuary Insurance

Group Funeral Insurance

Final Care Expenses